An Urban Improvement Precinct for Cato Ridge

The opportunity to create a safe and well functioning Cato Ridge has been taken business & commercial and industrial property owners.

The process is now underway for the eThekwini Municipality to approve the application and then enter a finance agreement. Approval is expected in March 2026 for launch in July 2026.

AGM: Cato Ridge Development Precinct

(6 February 2026)

Documents that were considered at the AGM

Thanks to all who attended.

Q&A

Much information is in the Marketing Brochure and Draft Business Plan and Final Business Plan.

1. What is a SRA or UIP?

A Special Rating Area (SRA), also known as an Urban Improvement Precinct (UIP) is a well entrenched mechanism to complement Municipal basic services, thereby protecting and enhancing property values and addressing business continuity risks.

Associated application documents

SRA/UIP Marketing brochure (a summary of the activities and benefits)

Draft SRA/UIP Business Plan (as presented at Special Open Meeting held 7 August 2025)

Special Open Meeting Pack (including elected Steering Committee Members)

Special Open Meeting Voting Record (20-0 to proceed (1 abstained)

Newspaper adverts (that appeared on Thursday 18 July 2025 in the Daily News and The Mercury)

Notice for the special open meeting distributed by hand and email to all business & commercial and industrial property owners. This was held on 7 August with 21 ERVEN represented.

Please check back as further relevant documents and updates will be made available here.

Target Achieved!

The ‘special rate’ in a defined area (SRA) is the mechanism by which one achieves an ‘urban improvement precinct’ (UIP). The terms SRA and UIP can be used interchangeably.

2. Simply, how does it work?

Contributors agree an amount that the Municipality will collect as a ‘special rate’ on contributors’ rates bills. These special rates are paid over to a Non-Profit Company, whose Board of Directors are made up of contributors. The Board oversees expenditure of this income for the benefit of contributors. Typical activities include additional security, cleaning & maintenance, precinct & general management services.

3. Why was the SRA/UIP concept introduced in eThekwini?

To address urban decay, improve safety, cleanliness, and investor confidence. The municipality acknowledges that it alone can’t provide a premium level of service. It is a mechanism for property owners to co-fund and control improvements in their area.

4. What is the relevant Legislation and Policy?

SRAs are governed by Section 22 of the Municipal Property Rates Act (i.e. National Government). Setting some principles it directs Municipalities to develop policies to practically manage SRAs.

In Durban eThekwini Municipality’s Economic Development Unit manages SRAs. eThekwini has a thorough SRA Policy, first promulgated in 2007, updated in 2015, 2018 and 2020.

5. What additional services do SRA/UIPs typically provide?

Security patrols

Cleaning and litter removal

Infrastructure maintenance (e.g., pavements, signage)

Landscaping and greening

Stakeholder engagement and municipal liaison

Social development support (e.g. dealing with vagrancy)

6. What are the benefits for property owners?

Improved area safety and cleanliness

Higher property values

Better public space management

Increased tenant retention and investor interest

Stronger stakeholder collaboration

7. Who controls how the SRA/UIP funds are spent?

A Non-Profit Company (NPC) run by property owners manages the funds. The board is elected by contributors and is accountable to members and the Municipality.

8. What is the process to launch it?

eThekwini Municipality SRA policy dictates this process. It is thorough to ensure transparency, fairness and that all contributors and the general community can input. For a ‘Commercial SRA’ support must be obtained in respect of at least 50% plus 1 of all properties categorised as ‘Business and Commercial’ and ‘Industrial’ , with residential and other properties within the SRA/UIP boundary not being liable for the special rate. This is the proposed contribution model.

Notice of initiation - Done

Perception Survey - Done

Preliminary Business Plan - Done

Special Open Meeting (with associated notifications per the SRA Policy) - Done

Business Plan - Done

Memorandum of Incorporation - Done

Assent to establishment - Voting for/against it by proposed contributors - Done

Intention to apply - Done

Objection form - No objections received - Done

SRA Application form - Submitted to eThekwini Municipality along with business plan, votes, objections etc. - Done

Notice of Activation - Sent by eThekwini Municipality - Awaited

9. Assuming 50% +1 of the contributors support it, when will it start?

The UIP will launch in July 2026, after the eThekwini Municipality approves it and it is integrated into their Financial systems and the Municipal budget.

10. Does the Municipality reduce services that we already pay for?

Absolutely not. Through having a formal partnership with the Municipality and a full time, in-precinct management there will be improved service delivery from the Municipality and other Government departments.

11. This is unaffordable. How can I object?

The proposed special rate for Cato Ridge is 6.5% of rates which are themselves about 3.7% (commercial) or 4.8% (industrial) of property values. The special rate is therefore about 0.019%-0.026% of property value per year. We don’t believe that this is unaffordable, especially contrasting with the services delivered and value attained through an SRA.

Assuming it achieves 50%+1 support from contributors, there will be a well publicised opportunity to object.

12. If I don’t support it do I have to pay?

Yes, is 50%+1 of the proposed categories of special ratepayers (business & commercial and industrial) support it then all these ratepayers have to pay. It is added to your municipal bill.

Note that residential, agricultural, vacant land and all other property categories are not impacted.

13. Why can’t we do something similar and not involve the municipality?

Unfortunately many firms would not contribute at all and some would contribute sporadically. It would be difficult to agree on a fair mechanism for contributions. A UIP ensures that if the majority support it then every property owner in the relevant rates categories contribute. This is fair as all benefit and it ensures sustainability of the initiative.

14. Won’t the municipality just take and spend our special rates, as they do regular rates?

This is counter to the National Government Policy and eThekwini Municipality’s own SRA policy. This has never happened in the 18 years SRAs have operated in Durban.

15. What is the likelihood of success?

There are about 59 contributors - freehold properties and sectional title schemes that are rated business & commercial and industrial. Reviewing this list, the initiators are confident that at least 50% will be supportive given the strong value proposition that it offers.

16. Can the special rate be increased in future?

Yes, but only through formal consultation and majority approval by contributors and eThekwini Municipality during the annual budget and business plan process.

17. What happens if the UIP underperforms?

The SRA agreement includes accountability mechanisms, including audited financials and annual performance reviews. Persistent non-compliance can lead to dissolution by the municipality. Members can also vote to dissolve it.

18. Why a Hammarsdale and a Cato Ridge UIPs. Why not have one?

The area must be ‘contiguous’ or connected. As these centres are quite far from each other, one UIP would include a lot of ‘non-core’ space. Having focused areas (while still large) improves accountability. While most issues are common the specific pothole, water leak etc. relate to either Hammarsdale or Cato Ridge. Synergies will still be secured between the two UIPs.

19. How do I actually pay the ‘special rate’?

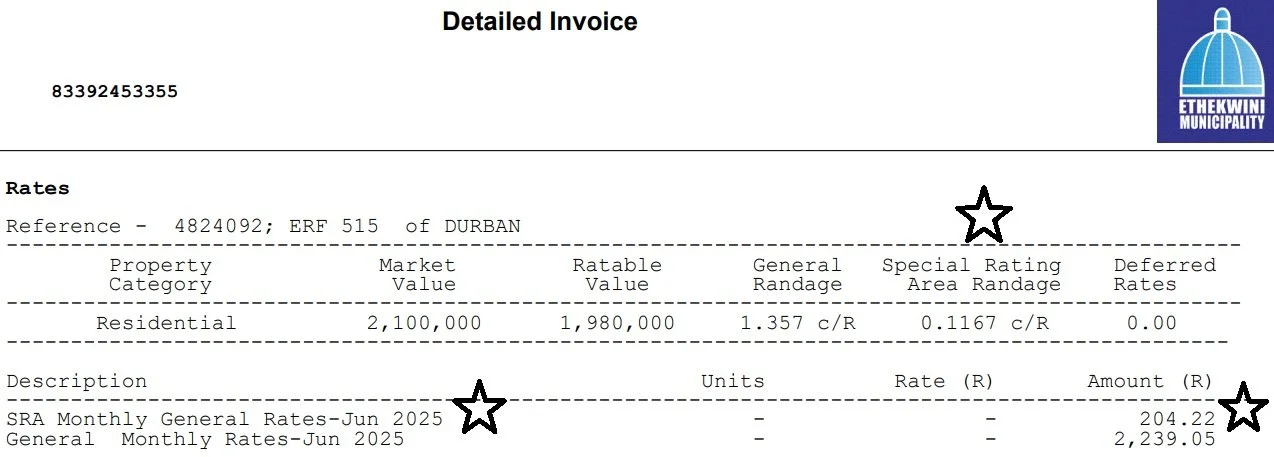

It appears on your municipal bill per the example below. You pay as normal with your monthly rates. Note that this is for a residential property.

20. How does this work for sectional title properties?

Sections vote to either support the SRA (or not) through a process coordinated within the sectional title scheme This aggregated support (or not) then counts for one vote, along with votes from all other relevant property owners. The initiators will supply the documents from the Municipality to undertake this voting process. Special rates are levied as per point 19 above.

21. Why not get residents in the area to also pay? They will benefit.

The residential properties are not valued very highly. Their contributions would therefore be very small. Having a mixed SRA/UIP (of business & commercial, industrial and residential properties) means that the threshold for approval would increase to 66%. It is unlikely that this threshold would be achieved as there are many residents would have to approve it and this is unlikely to be achieved.

22. What will happen to the HCRDA NPC?

Many of the services it currently provides will be undertaken by the UIPs, while at a much greater scale. HCRDA NPC will continue to operate and welcome voluntary contributions to undertake complimentary area development activities. It is a Broad-Based Black Economic Empowerment (B-BBEE) Level 1 Socio-Economic Development (SED) Beneficiary so firms can use it to secure B-BBEE points and undertake effective local empowerment activities.

Please be in contact with any further questions on info@hcrda.org or on 087 147 2531.